Here’s Why Establishing A Tax Home Is Important For Travelers

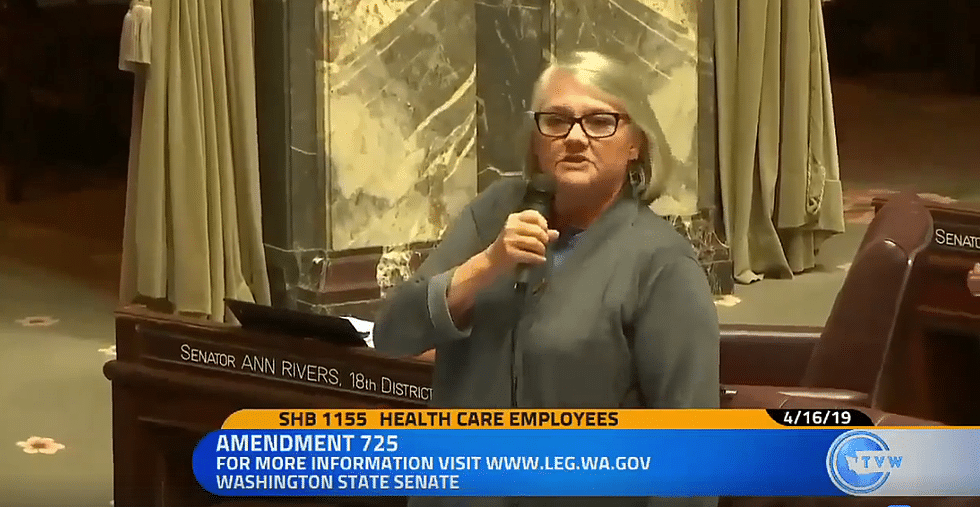

Thanks to President Donald Trump’s approval in December of the most extensive changes to U.S. tax law in the past 30 years and the recent start of income tax filing season, millions of U.S. citizens have taxes on the brain, travel nurses included.

The new tax changes won’t affect the filing process for 2017 taxes. They do eliminate employment expense deductions starting this year, but they won’t affect the tax-free stipends available to travelers, as long as they’ve established a tax home.

But what is a tax home? For a busy professional who regularly has to travel for business, qualifying for tax-free stipends is a simple process, but for travelers, it’s a bit more complex.

Definition and benefits of a tax home

The IRS Tax Code defines a tax home as the geographical area where workers earn most of their income, which may not be the same place as their permanent residence–the place where they own a home, where their family lives or where they’ve been issued a driver’s license.

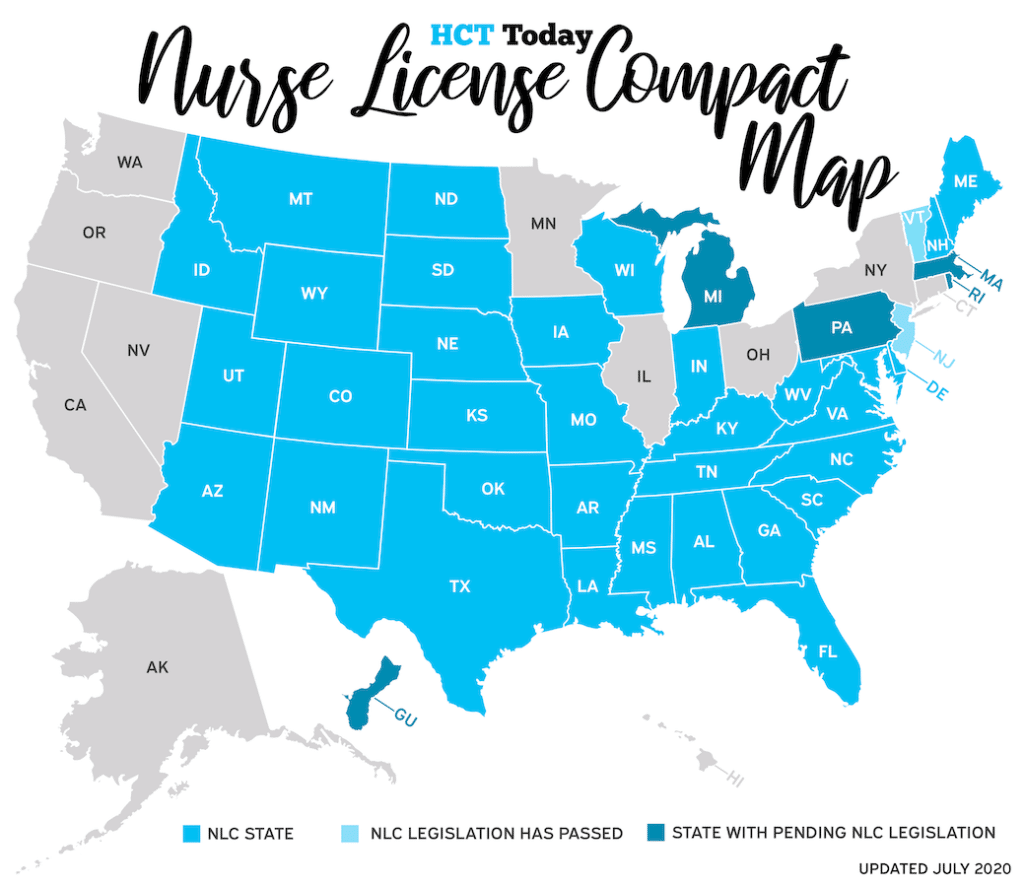

As an example, say an employee works for a company in Michigan eight months out of the year, but that person owns a home in Wyoming to stay close to relatives. The employee’s company asks him to travel back to Wyoming for a business-related reason, so he decides to stay at home because it’s easier than booking a hotel for a weekend. Even though this person traveled to their personal residence, the employee’s travel expenses are still technically deductible because he is leaving his tax home on business.

Having a tax home means big savings in terms of a travel nurse’s ability to accept tax-free stipends, or per diems, which can add up to anywhere from $20,000-$50,000 in tax-free benefits. “This can result in $6,000-$9000 per year in tax savings,” said Joseph Smith, a travel nurse tax expert and owner of TravelTax.com.

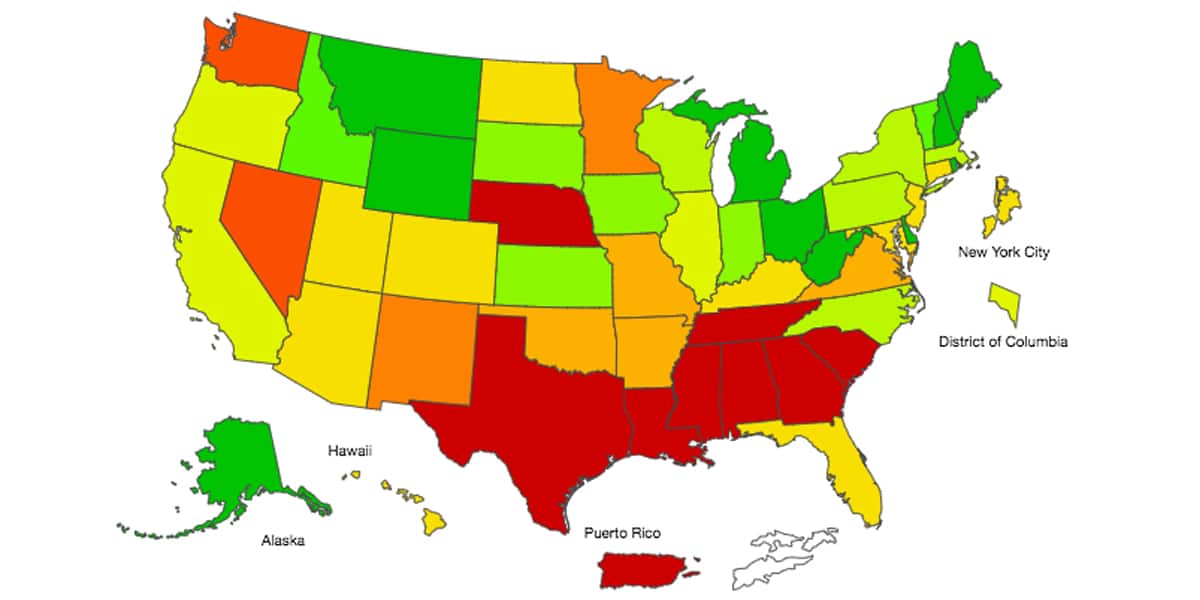

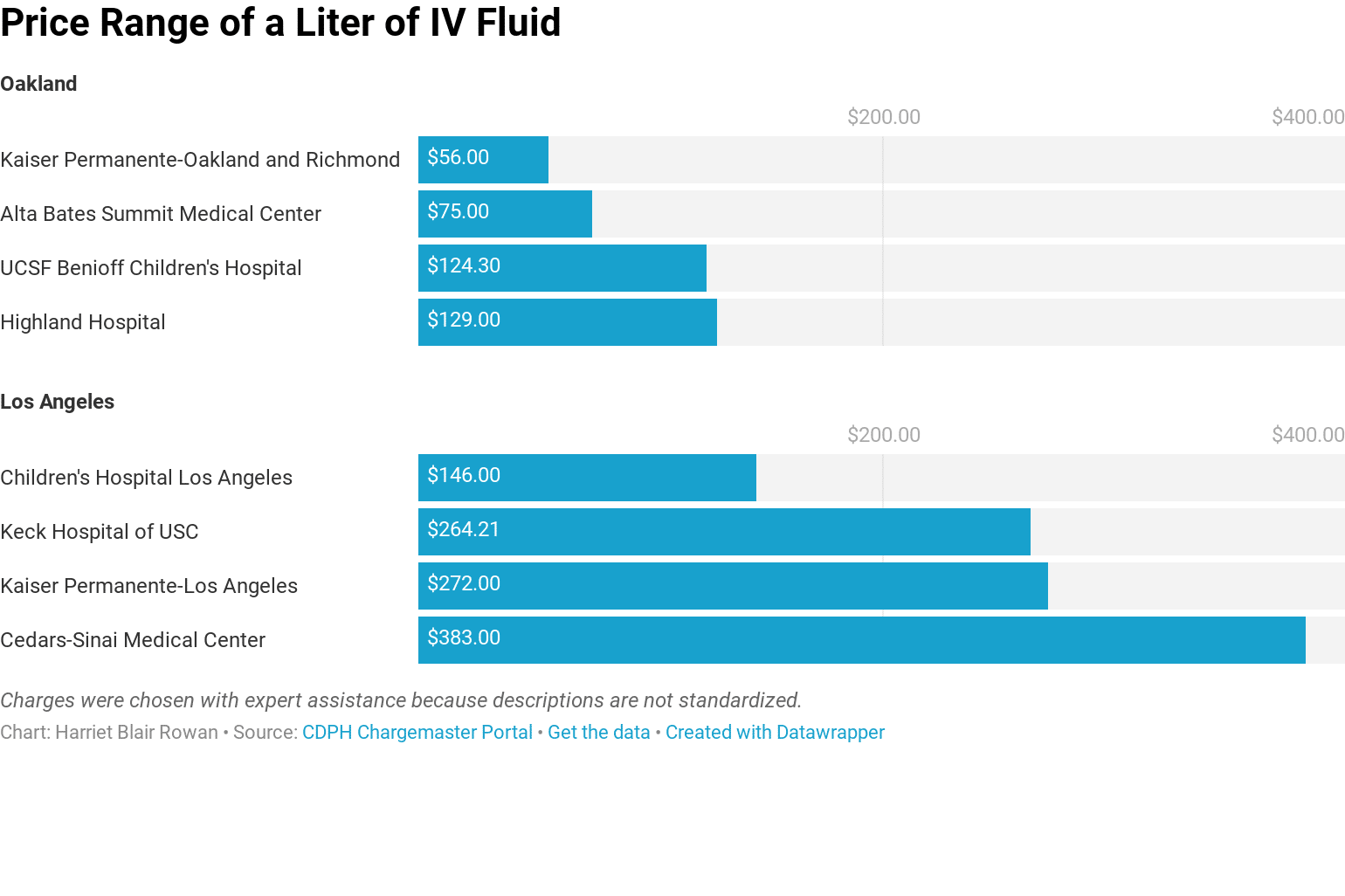

“But then you have to remember to subtract your living expenses from that (savings figure),” Smith said. “If you’re paying 600 a month for an apartment, which is then $7,200 a year, that’s a significant amount from savings. That’s why you don’t see travelers living in places like San Francisco unless they have a tax home due to a regular job in the area.”

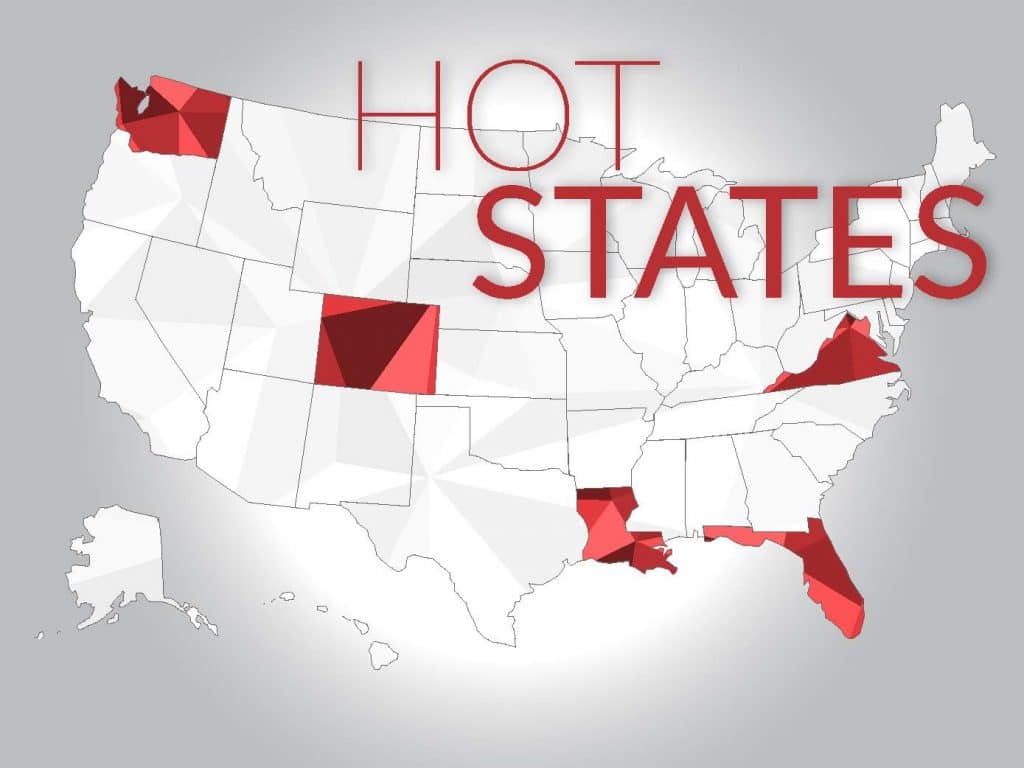

Some travel nurse staffing agencies also won’t give contracts to nurses who don’t have a tax home in order to avoid being penalized during an IRS audit because of a travel nurse who accepted tax-free stipends without a tax home.

Criteria to qualify for a tax home

If this geographical definition was the only one used to determine who has a tax home, travelers would never qualify since the job requires frequent relocation, meaning there’s not one place where they earn a majority of their income.

Thanks to clarifications of the code in IRS Publication 463, three factors are used to determine tax home status. At least two of these three criteria must be satisfied in order to qualify for a tax home. If only one factor is met, that person is considered an itinerant worker, meaning their tax home is their permanent residence and they don’t qualify for tax-free stipends or reimbursements.

- You perform part of your business in the area of your main home and use that home for lodging while doing business in the area.

- You have living expenses at your main home that you duplicate because your business requires you to be away from that home.

- You have a member or members of your family living at your main home or you often use that home for lodging.

Since most travelers don’t work at home, they often try to meet the second and third criteria to establish a tax home. The third criteria is easy enough to meet by returning regularly to a home or apartment owned or rented, but their tax home status could be disrupted by not matching duplicate expenses.

Duplicate expenses

While it’s not stated in bold print, duplicate living expenses need to be significant enough to meet the second criteria.

For example, say a traveler rents an apartment for $800 per month in their home state of Arizona, and leaves for a five month job in Colorado. They have a friend in Colorado who owns a home and will let them stay in a spare room for $50 a month while they’re working. Even though the traveler is paying the friend to stay there, that incredibly low “rent” charged by their friend won’t qualify as duplicated expenses.

That traveler would need to at least pay fair market value for rental of the space, which differs based on location but can be determined by comparing local rental listings for similar properties.

Temporary worker status

It is possible for travelers to avoid paying duplicate expenses and still qualify for a tax home by meeting the first criteria and planning to work some in their home state, but they must make sure they are a significant distance away from their permanent residence or risk losing their temporary worker status.

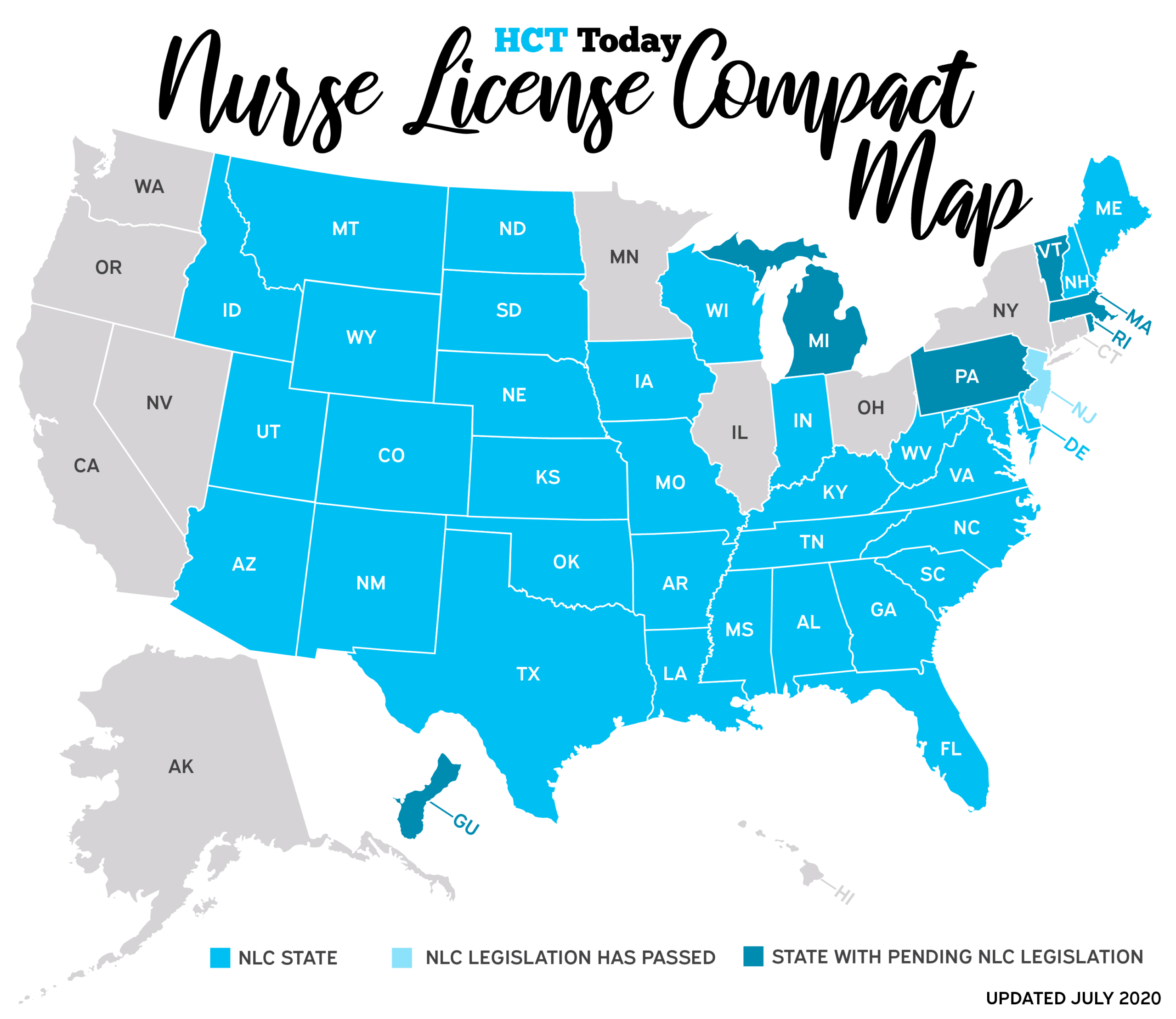

A temporary worker is someone who fulfills job appointments lasting 12 months or less, according to the U.S. Department of Labor Statistics. If a traveler works for more than a year in a single geographic area, it’s considered an indefinite job appointment. That means their previous tax home is moved to their current job because it’s their new primary location of income, and they are classified as an “itinerant” worker.

This rule applies even with short-term contracts. If a traveler plans to work in a location for eight months, then accepts another five month contract in the same area but at a different hospital, the job assignment would still be considered indefinite rather than temporary since they planned to stay for 13 months total in the same geographic region.

Unfortunately, there isn’t a specific distance a traveler needs to be away from their previous placement to be considered safe, and the “50-mile” rule travelers might hear about is not actually defined by the IRS. The rule of thumb here is it should cost enough to travel that it would still duplicate your regular living expenses.

It’s possible to be an itinerant travel nurse and not have to maintain a permanent residence. Just remember that everything becomes taxable at that point–this includes all monetary reimbursements and non-cash benefits.

Knowing the rules

Every traveler’s tax and travel expense needs are different. But knowing these criteria can help establish a good foundation for planning where travelers want to work.

“It’s always helpful to consult a tax advisor,” Smith said, “but one of the most important skills a new traveler should develop is the ability to sort through misinformation, and that can sometimes include information provided by an inexperienced recruiter,” he continued.

Part of a new travel nurse’s job is to understand the core concepts of tax homes by doing their own research on the topic and considering what option is right for them.

“One of the harder things to convey to people going from a regular nurse with one job to working as a traveler is that they are no longer just a nurse; they’re a multistate professional,” Smith said. “If your goal is to travel, then you’re willing to travel with or without a tax home–but you need to plan it out.”