Tax Season Tips for Healthcare Travelers

By Alex McCoy, Contributing Writer, Owner of Fit Travel Life

The season of the year that has accountants working in overdrive and everyone just a little stressed about their finances is upon us: tax season.

As a new traveler, this time of year can seem particularly stressful if you are unclear on what you need to do differently as a traveler to make sure all of your finances are in order. Luckily, there isn’t too much difference in the way of actually filing your returns, but it is important to be familiar with tax laws to avoid any issues if you happen to get audited (knock on wood no one reading this has that happen!)

Also, I want to note that I am not actually a tax professional–I am simply sharing my experiences and tips to stay a little more organized and get through filing your returns as seamlessly as possible.

Tip #1: Have all of your W2’s sent to the same address

While some travelers prefer to use mail forwarding services so they can get their hands on their mail without relying on a friend or relative to forward it if you move around during the time when your tax documents are getting mailed out you increase your risk of missing something important.

What I have found to be easiest is to make sure all the staffing agencies I work for have the address to my tax home which happens to be my mom’s house. I give her a list of how many W2s I am expecting and what companies they should be coming from. This way she knows when they have all arrived and she can simply send one package with all of my paperwork in it.

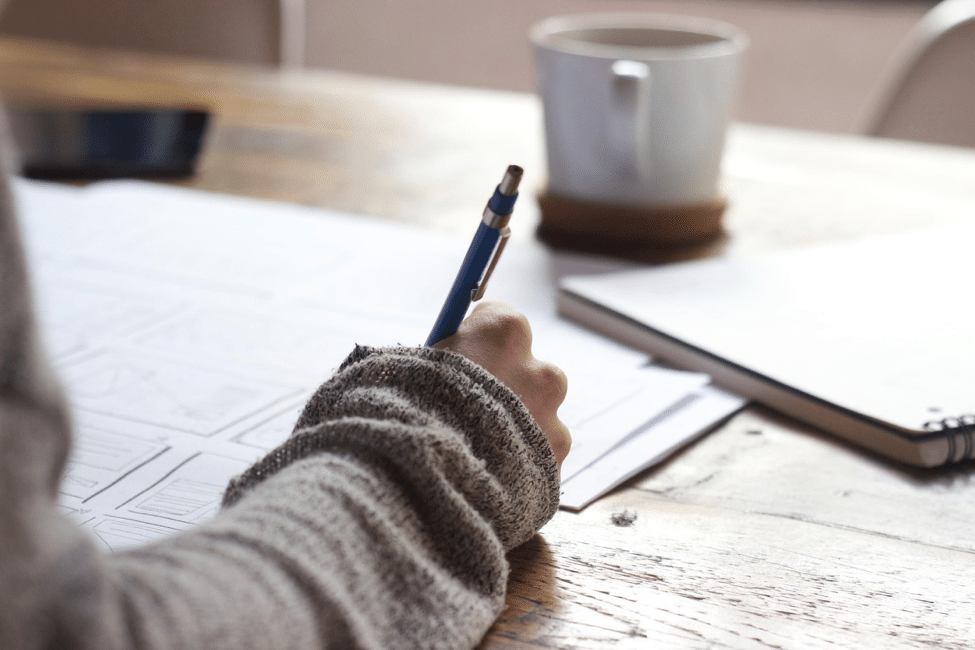

Tip #2: Keep track of any online payroll logins for the agencies you work for

A lot of companies have transitioned to digital versions of tax documents or they do a paper and digital copy. This is actually really handy because you don’t have to wait for your physical mail to make its way to your current location before you can file.

The trick comes when it is nine months from the time you signed up for the payroll access and you have no clue what your login might be at the three different agencies you worked for. Head this off by keeping a list somewhere safe of your username and log in for all of your employers, even if you don’t plan on using the site to check your pay stubs regularly. This could save you a lot of time and headache if you can’t track down your W2.

Tip #3: Look into using a personal accountant

These days it is really easy to get your hands on software that makes filing your taxes by yourself somewhat easy. However, this software might not address specific questions or concerns that come up regarding travel pay or stipends.

Because of this I highly recommend looking into a real-live personal accountant. Most of them are familiar with how stipends work (lots of different professions provide living stipends). Plus they can make sure you have all the paperwork to legally collect your stipends and help prevent you from getting into any sticky situations with the IRS. Also, a local accountant is probably a lot cheaper than you would anticipate so don’t let cost be a reason to deter you from hiring someone.

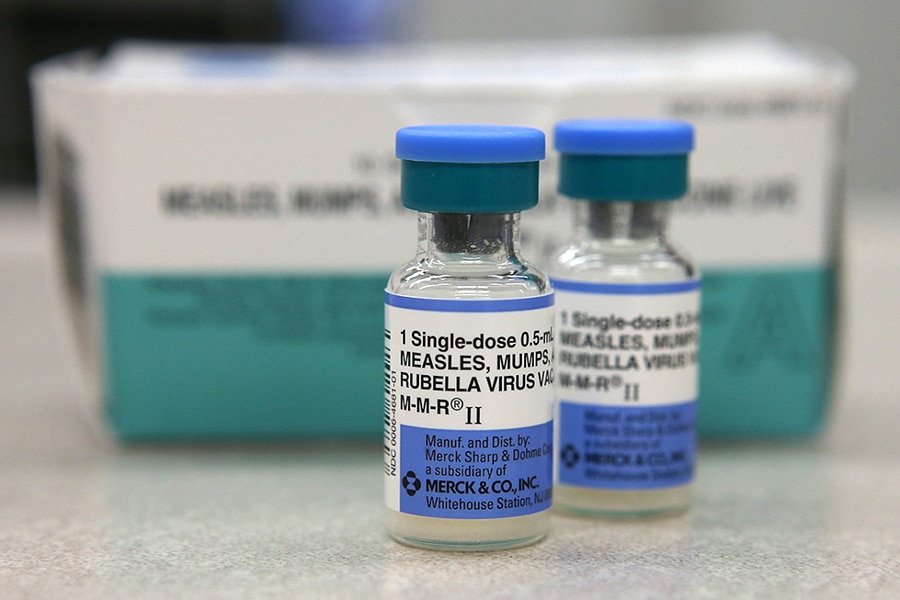

Tip #4: Keep a digital or paper trail of any housing payments you make

You can read all about how to maintain a tax home here. The key takeaway I want to touch on is that you have to have proof that you are making some sort of housing payment back home and wherever you live on assignment.

Even if you are renting a room from your mom back home, you need to make sure to have proof of the payments you are sending. This can be as simple as scheduling a bank transfer or sending a payment via PayPal or Venmo. Most landlords will also use electronic payment methods, but if for some reason you pay cash or use a paper check be sure to get a receipt and keep track of those in case you are audited.

Tip #5: Don’t stress

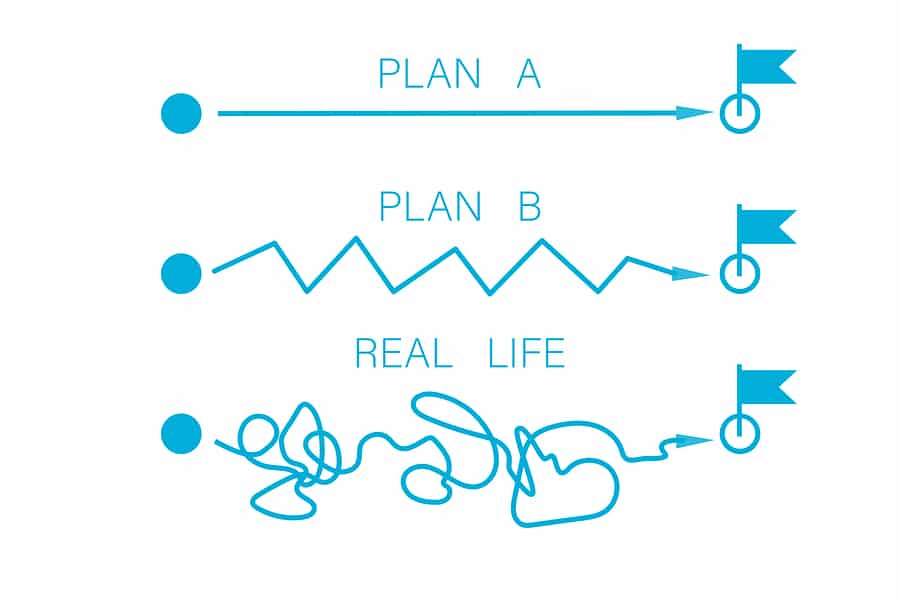

With stipends and words like “taxable” or “tax-free” coming into play when you learn about traveler pay, it may seem like filing taxes as a traveler is going to be incredibly complicated.

Luckily if you work through an agency as a W2 employee there is not much more to filing than if you work a regular job. There may be more pieces of paper to keep track of since travelers often bounce between agencies, but your agency should take care of deducting proper taxes and all of that ahead of time.

Filing taxes as a traveler really isn’t that much different than dealing with tax season as a permanent staff member. Stay organized, hire a professional, and make sure you are maintaining a legal tax home and it should be a smooth process.

Alex McCoy currently works as a pediatric travel nurse. She has a passion for health and fitness, which led her to start Fit Travel Life in 2016. She travels with her husband, their cat, Autumn and their dog, Summer. She enjoys hiking, lifting weights, and trying the best local coffee and wine.