Tips for Paying Off Debt as a Travel Nurse: Minimizing Housing Costs

By Alex McCoy, Contributing Writer, Owner of Fit Travel Life

Every individual will have a different reason for choosing the travel nurse lifestyle. Some people want to see the country, some value extended time off between contracts for international travel, and others simply want to avoid the politics that come along with staff nursing. However, one huge draw for many travelers is the increased pay compared to staff pay at home. The pay increase alone is enough to draw parents to work three days away from home and fly back in between, for spouses to leave their partners behind, and for seasoned nurses to leave huge hospital systems with great benefits.

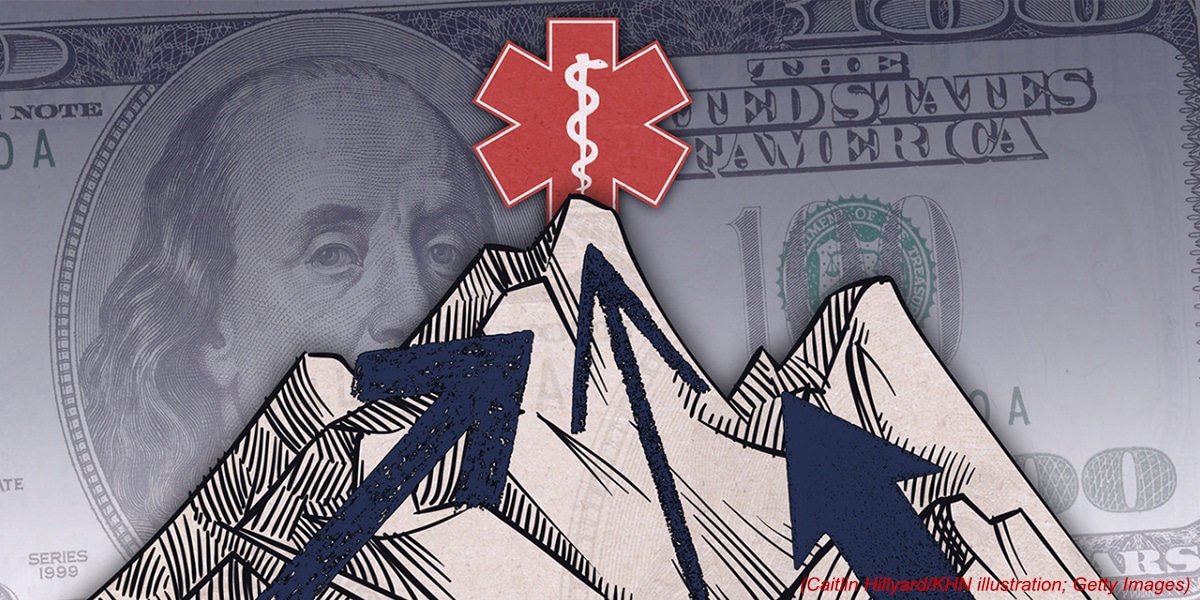

Student debt and overall debt is a hot topic these days and with the average college graduate taking on around $30,000 in student loans many people feel behind before they even start working. As a result, there has been a surge in the number of people eager to get out from under this debt as quickly as possible. For many people, travel nursing can be a useful tool for making this happen without sacrificing as much in your day to day life. By increasing income on the road and minimizing expenses, it may be easier to pay down loans and credit cards faster, allowing travelers to have full control of their entire paycheck once this burden is gone.

Start by minimizing expenses back home

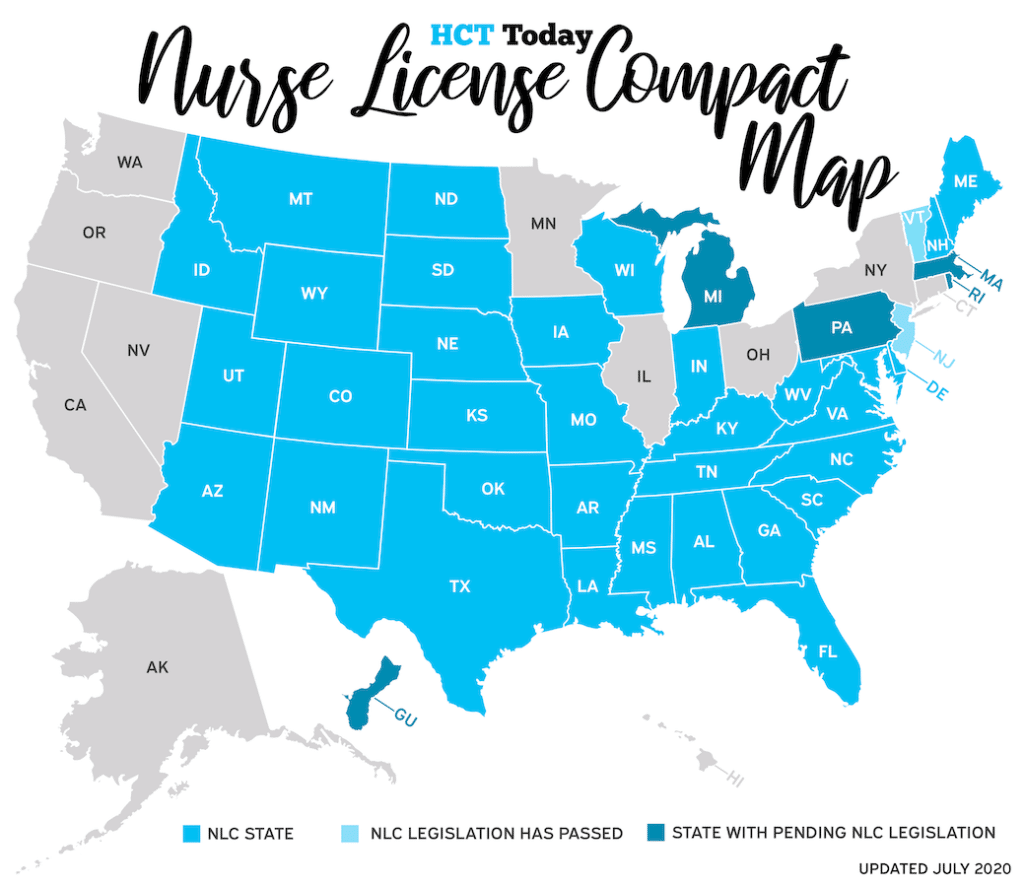

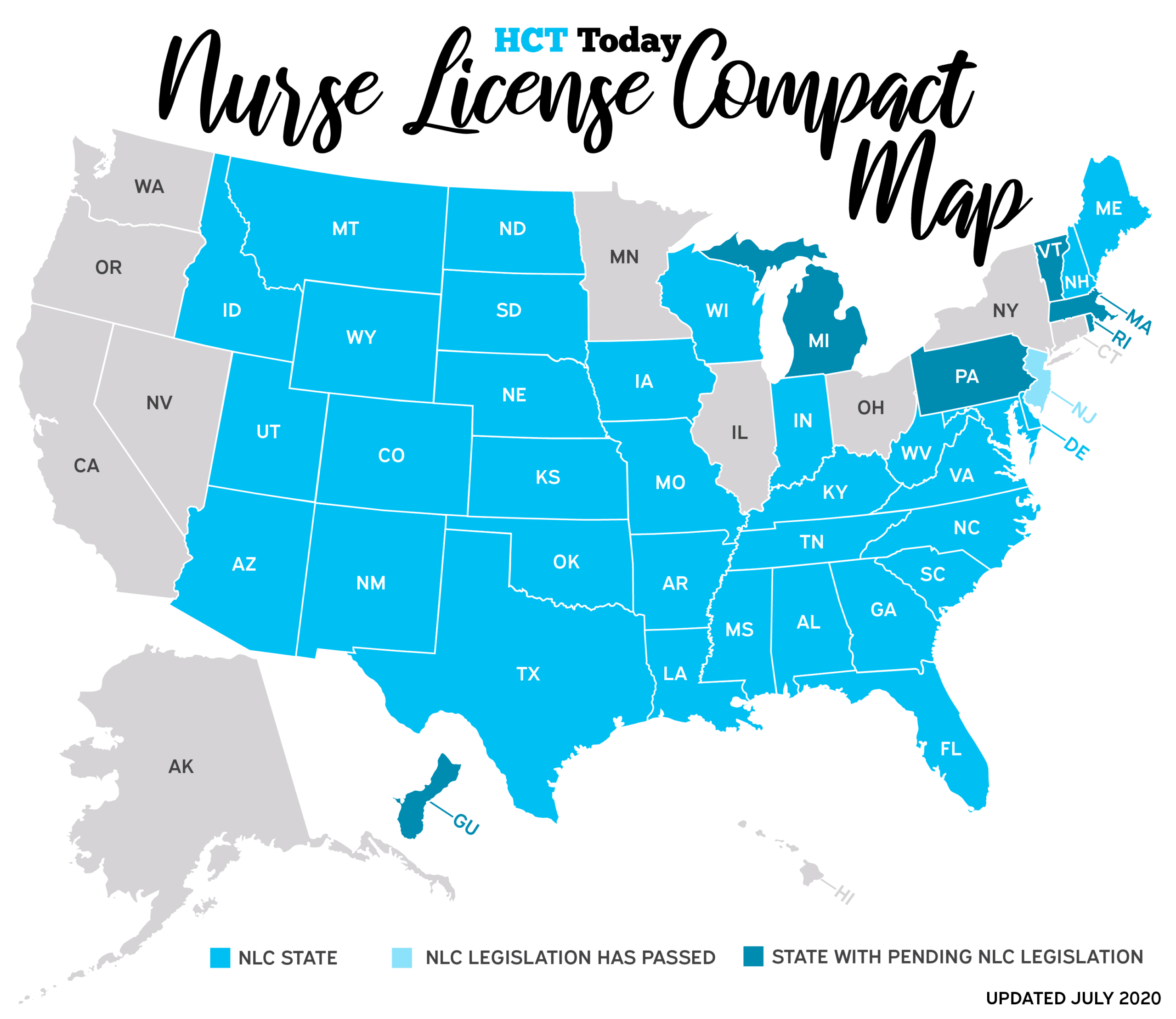

To legally take a housing stipend and per diem, you must maintain a tax home somewhere in the United States. To make sure you are hitting all the requirements for a tax home I highly recommend TravelTax.com or consulting with a tax professional.

However, when you are deciding how to maintain your tax home there are a couple of ways to cut back on your rent and expenses.

The first way is to rent a room or split the cost of housing with a roommate. If you rent directly from a friend or family member be sure to pay fair market value (you can’t pay mom $100 a month and call it “rent”). Or you could sign a lease with a friend and use this as a place to store furniture and crash when you are home between assignments.

If you own a home you can opt to rent a room to a friend or family member while you are away. You must reserve space for yourself to keep it as your “home” so using it as an AirBNB or something similar might be more tricky. Having a friend or family member stay there is also handy because they may be able to do some upkeep and monitor the property while you are away.

The other way to minimize expenses at home is to downsize as much as possible. While it may seem tempting to simply rent a storage unit and put all of your belongings there, keep in mind that if you travel for several years the cost of the storage unit may overtake the cost of simply replacing items when you come home. If you don’t have a cheap way to store items back home, try to downsize to the bare minimums or keepsake items and rent the smallest space possible for storage.

Next, minimize expenses on the road.

Some travelers hate the idea of driving cross country and talk about renting cars or paying for transport, but this is a huge cost that will not be covered by travel companies. I highly recommend driving to save money and to allow you time to explore our country as you drive.

Another way to save money on these trips is to camp or stay at KOAs instead of hotels. Most of the time you will only be stopping to sleep, so by pitching a tent or renting a small cabin at a KOA you can easily save money. Also, try to stick to smaller towns where the cost of living is lower than in larger cities.

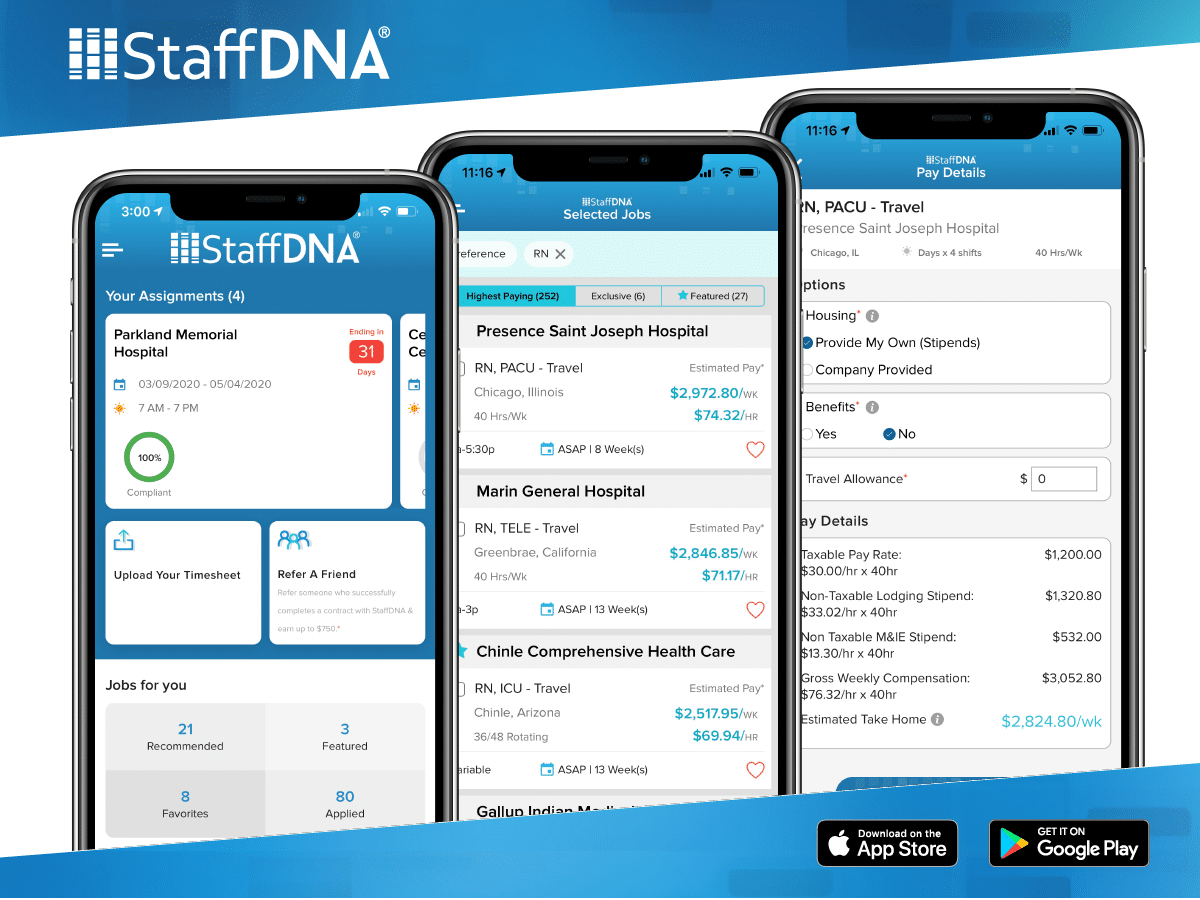

Once you are at your assignment an easy way to pocket extra cash is to share housing with other travelers or opt for a room rental over a private space. There are lots of travel nurse Facebook groups where people are looking for roommates, or sites like AirBNB or VRBO may have room rentals listed where you can negotiate a monthly price. Any bit of money saved on housing can be used to pay off debt!

Don’t forget to track your progress.

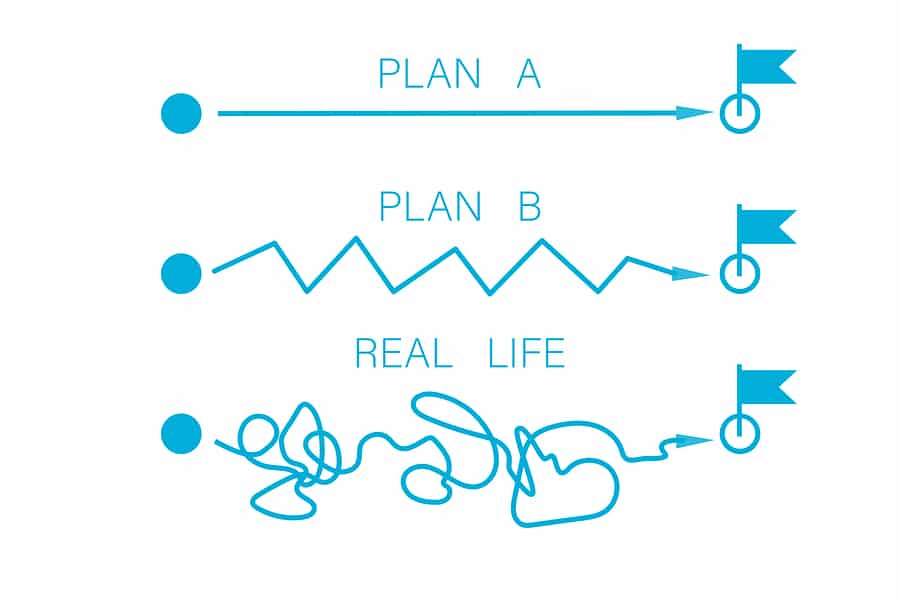

As travelers we often have to drop large amounts of money on deposits, travel expenses, car repairs…the list could go on. When these come up it can start to feel like we are making little progress on our financial goals. This is why it is so important to track how much you are putting towards your debt. When life gets a little crazy or unexpected expenses pop up, don’t forget to go back and reflect on the amount you have put towards your debt and celebrate that success!

Working as a traveler is a blessing for anyone trying to get ahead financially. If you manage your expenses correctly, this career path is almost guaranteed to be more lucrative than your typical staff job. Stay focused, remember how great you’ll feel when you are debt-free, and remind yourself that all the cost-cutting measures are temporary. You will feel amazing and so accomplished when you hit your goal!

Alex McCoy currently works as a pediatric travel nurse. She has a passion for health and fitness, which led her to start Fit Travel Life in 2016. She travels with her husband, their cat, Autumn and their dog, Summer. She enjoys hiking, lifting weights, and trying the best local coffee and wine.