Tips for Tax Season as a Traveler

By Alex McCoy, Contributing Writer, Owner of Fit Travel Life

It’s that time again–tax season! For travel nurses, it may seem like this time of year would be more stressful than when you held a permanent position, but it really isn’t too bad. As long as you stay organized ahead of time and know what you need to keep track of (it really isn’t much!) you will be fine.

Make sure each agency you have worked with has an updated home address for W2s.

While a lot of travel nurse agencies will have the ability to send a W2 virtually, every so often they will still mail out hard copies. Sometimes as a traveler, your tax home address may change, so make sure your agency mailed your paperwork to the correct address. Also, make sure whoever is in charge of collecting your mail back home is looking out for important tax documents. It can sometimes be a pain to get these sent again, so it’s best to try and stay on top of this part ahead of time.

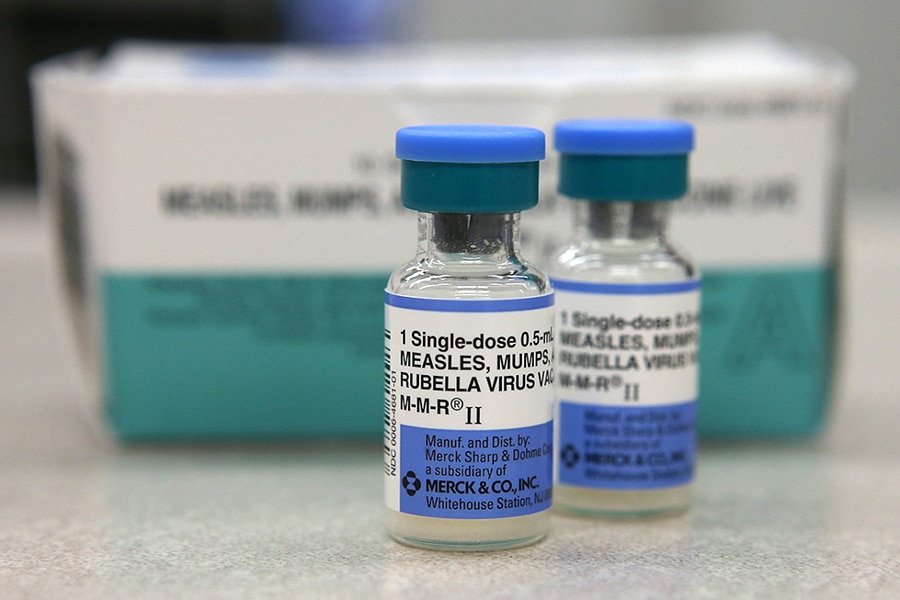

Keep track of documents that verify your tax home.

In order to collect tax-free stipend money, it is imperative that you are maintaining a tax home in your home state. One big piece of this is paying fair market rent to someone. This means even if you rent a room from a friend or family member, you need to have a paper or electronic trail tacking this. You don’t have to submit these with your taxes, but if you were ever to get audited this documentation would be crucial to have.

Know what to keep and not to keep.

One mistake that can make tax season seem very overwhelming is hanging on to every single piece of paper or receipt that you collect over the course of a year. There are actually very few items you really need to keep track of because recent tax laws have limited the number of deductions a travel nurse can take advantage of. For a good list of what you should and should not keep track of, check out the FAQ section over on Travel Tax.

Consider hiring a tax professional.

While there are a ton of options for DIY tax software out there, as a travel nurse you probably have a few more questions and usually, multiple W2s that can make doing your own taxes confusing. Even if you spend a couple of hundred dollars on a tax professional, it can save you a world of stress and potential audits in the future that is worth more than the price of a professional’s help. Travel Tax is perhaps the most well-known travel nurse tax professional, but you can also look for a local CPA or someone who a friend trusts to use.

Keep a running tab of each agency you have worked with.

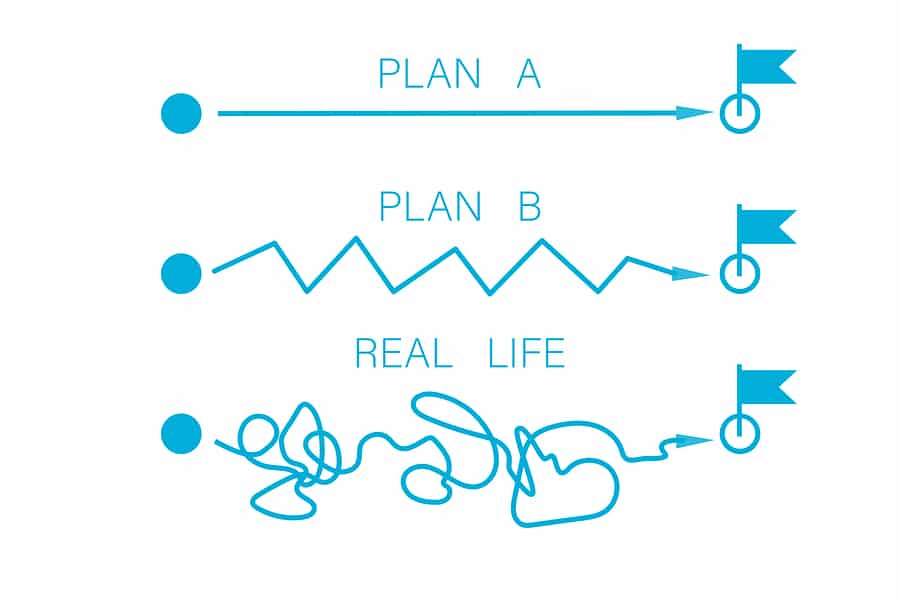

There is nothing worse than getting all of your ducks in a row and realizing you forgot about that one quick assignment you worked that one time with that one agency. A year in the life of a travel nurse can go fast–so be sure to keep track of each agency you have earned income through. This can be especially important if you work a lot of strikes or short-term contracts. Agencies aren’t going to hunt you down–they only have to document that they postmarked any tax documents by January 31st, so be sure you are watching out for those documents to show up.

Don’t forget to have copies of your contracts saved.

When it comes to tax season, the only income that will be recorded is your taxable income. For most travel nurses, this is around $25 per hour. If you decide it’s time to buy a home or a car, this can make getting a loan kind of tricky. Navigating this process is a whole different ball game, but by keeping your contracts you will also have documentation of the housing stipends and per diems you received. Then when you go to a mortgage broker, you can break down your income a little bit more and show that you can really afford more than what $25/hour would qualify you for.

All in all, going through tax season as a travel nurse is really not overly complicated. By hiring a reliable tax professional and staying on top of who owes you W2s, you really have all of your basic needs covered. Don’t overthink the process–compared to many other aspects of travel nursing it really is simple!

Alex McCoy currently works as a pediatric travel nurse. She has a passion for health and fitness, which led her to start Fit Travel Life in 2016. She travels with her husband, their cat, Autumn and their dog, Summer. She enjoys hiking, lifting weights, and trying the best local coffee and wine.