4 Steps For Filing A Tax Extension Before The Deadline

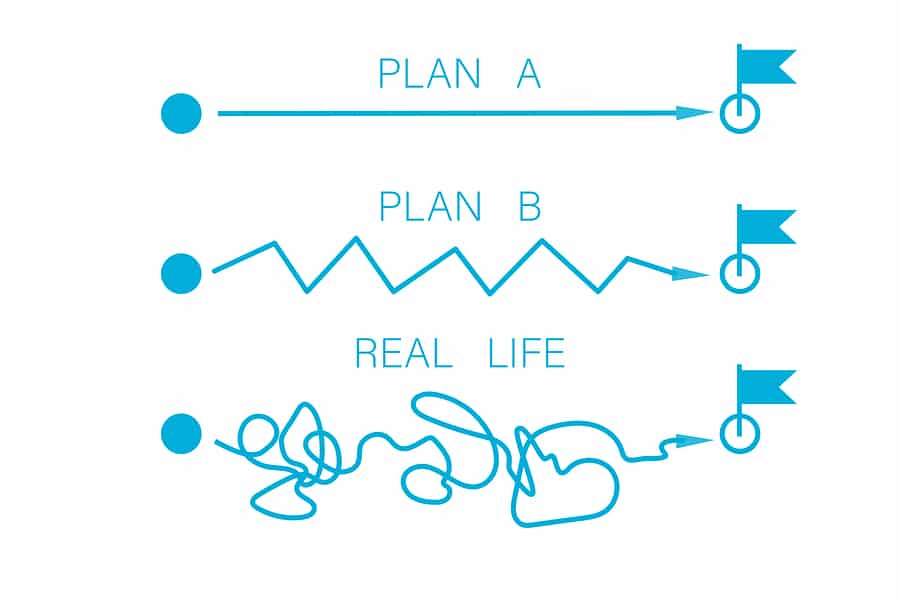

The average American may be able to do some last minute homework and get their taxes filed on time, but for travelers, it can be a major challenge to track down all the necessary information and documents since they work at multiple facilities and states every year.

Even if you have all the necessary paperwork and can file right away, travelers should still apply for an extension, which will give you until October 15 to properly file your taxes, tax advisor and TravelTax.com owner Joseph Smith said.

Reason being–It’s always better to take the extra time provided from an extension to file everything correctly than rush it and be at risk of potential massive penalties from an IRS audit in the future.

“Multi-state professionals should make extensions a part of their lives as they usually don’t get their documents until late,” Smith said.

For all of those forgetful folk and procrastinators out there, here are four easy steps to properly file your extension.

Step #1: Breathe

Just because you forgot to file earlier doesn’t mean the IRS audit fairy will knock down your door the next morning and steal the money from your wallet.

An estimated 10 million Americans file for extensions every year, both to ensure accuracy and to get the most out of their tax returns.

Extensions will help you avoid a failure-to-file penalty, which starts at five percent of your unpaid taxes for each month or part of a month that it’s late, up to a maximum of 25 percent.

Keep in mind that this doesn’t excuse you from the late payment penalty if you owe money, but the penalty for paying late is much lower than filing. It’s typically one-half percent of your unpaid taxes, but it also maxes out at 25 percent.

Step #2: Get Your Extension Form

You can download the extension form by clicking here, or by visiting the IRS website.

You can file your extension online or by mail. If you choose to file by mail, make sure to double check the bottom of the form because it has the mailing address where you will send the form. Also, make sure the mail is postmarked by April 17, or April 18 if you live in Maine or Massachusetts.

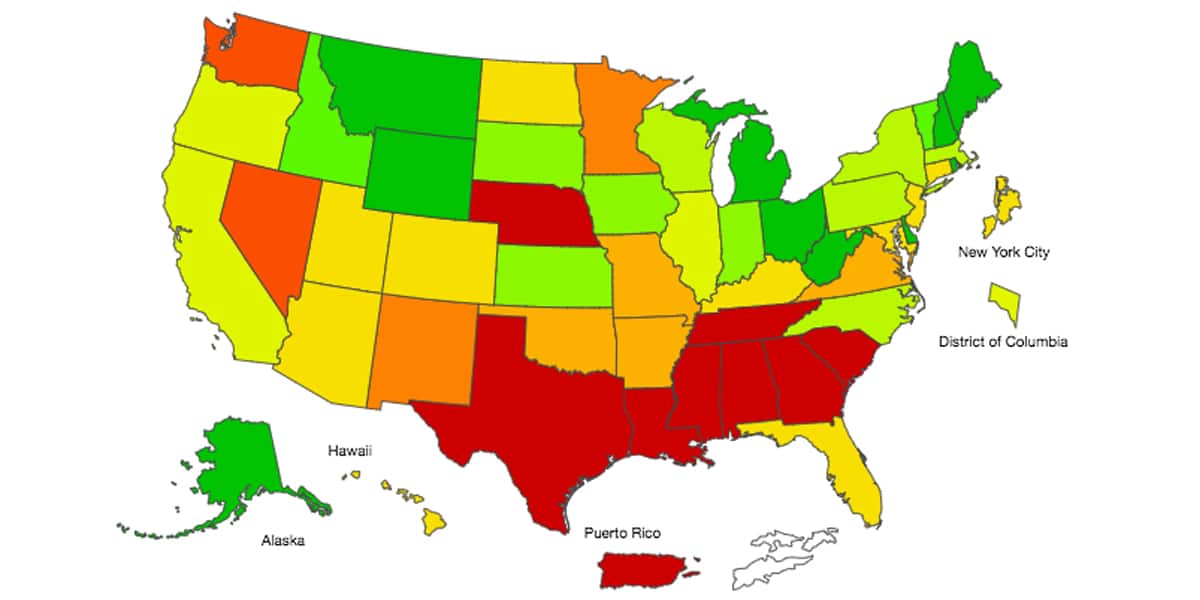

Step #3: Check your state tax extension rules

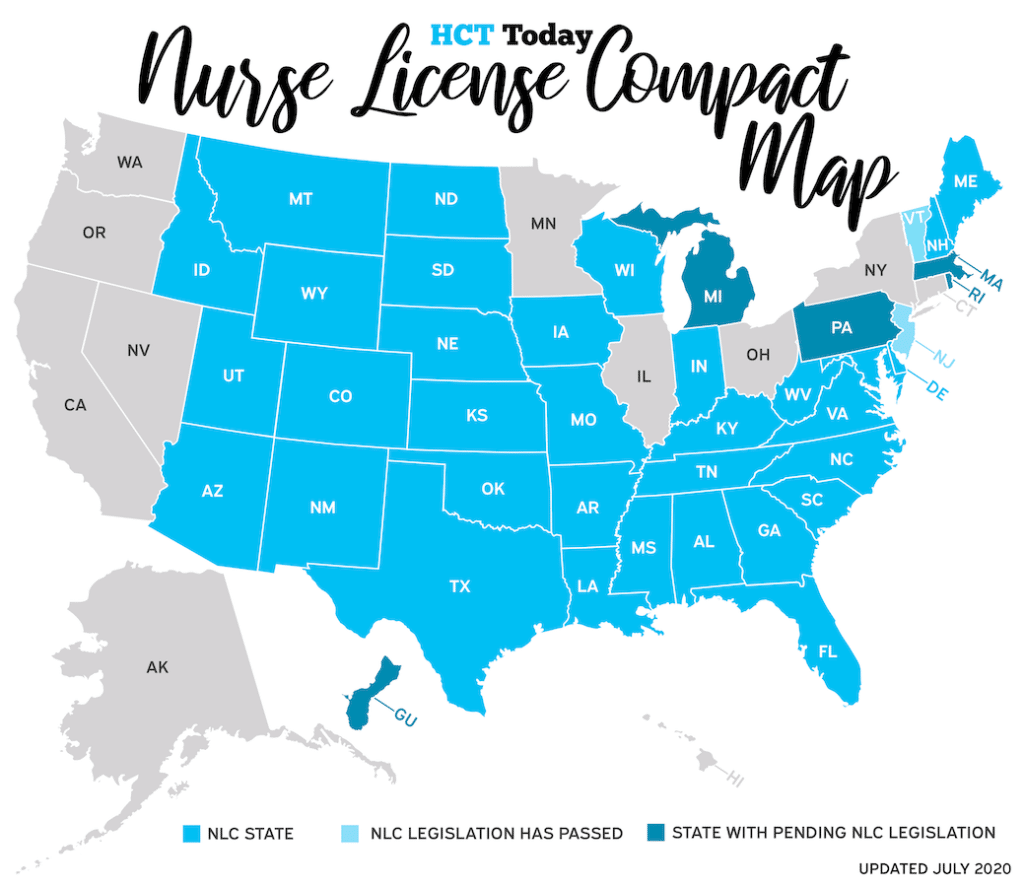

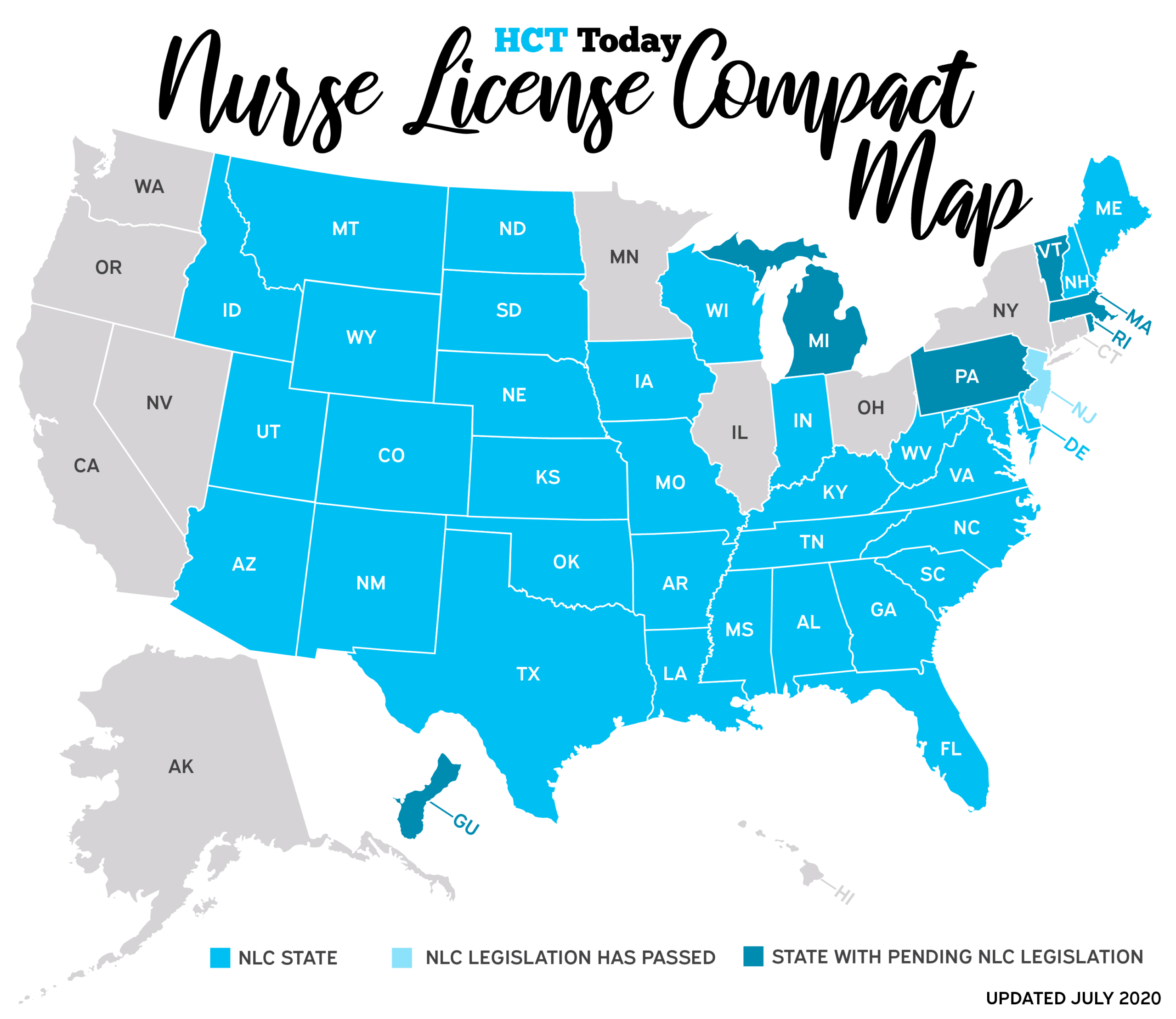

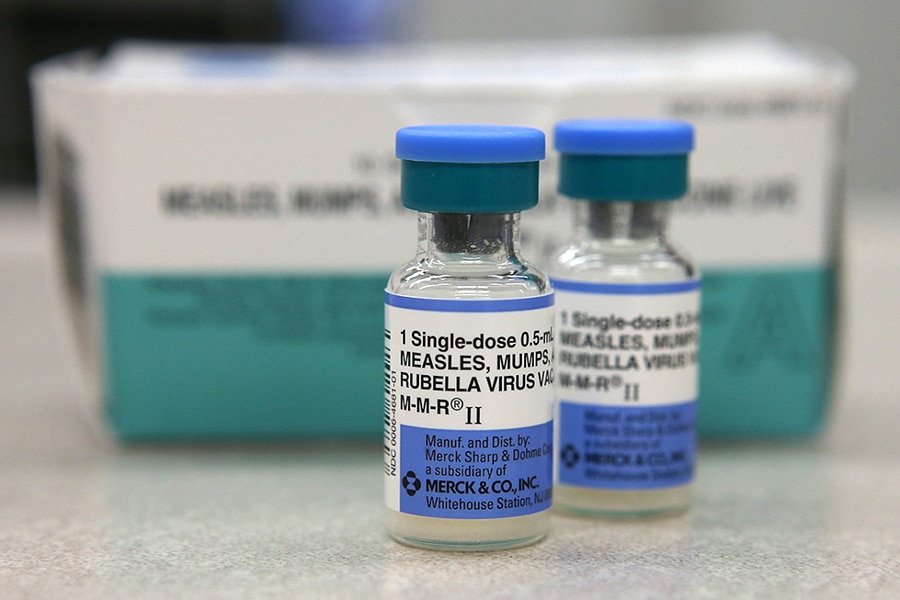

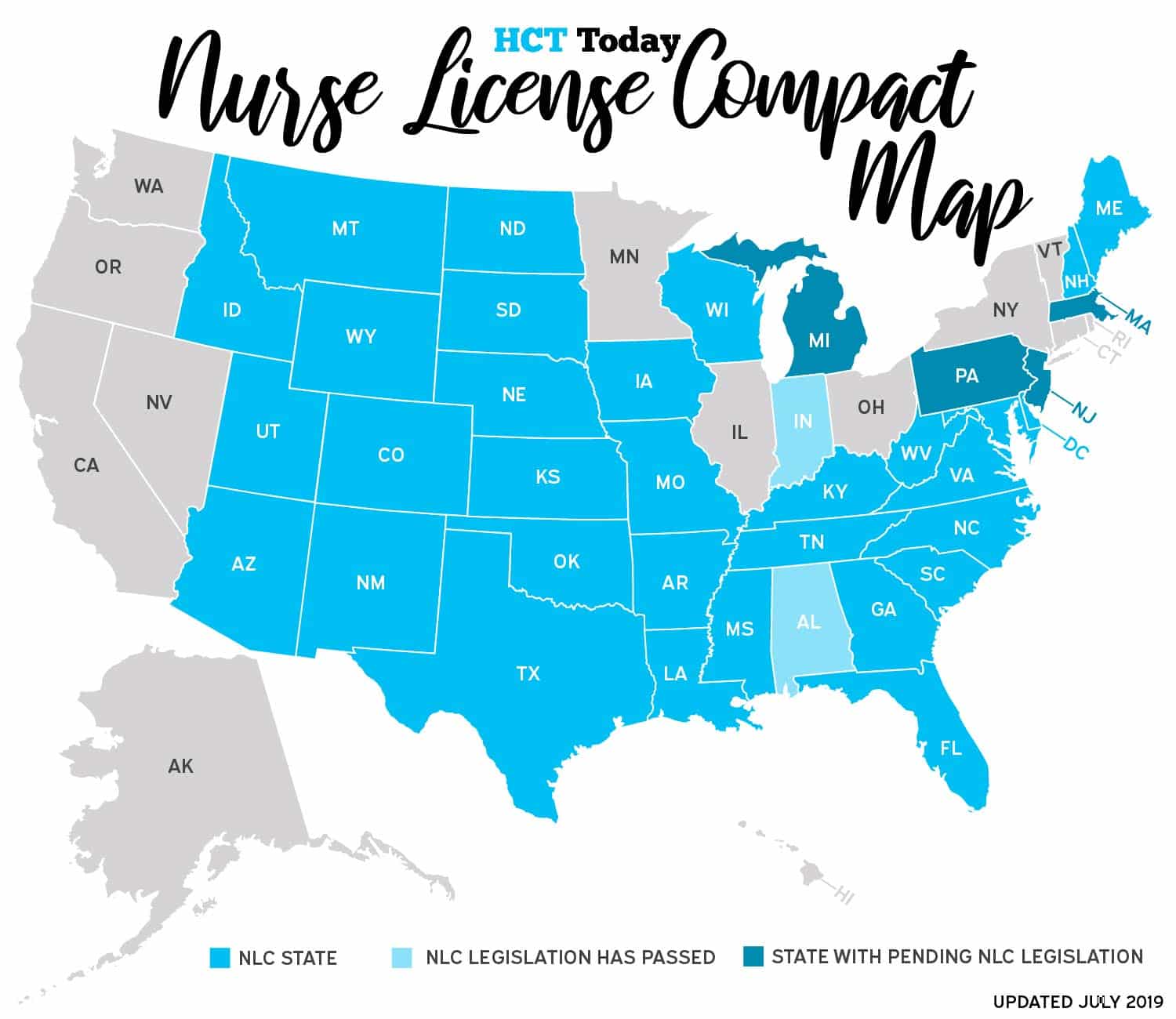

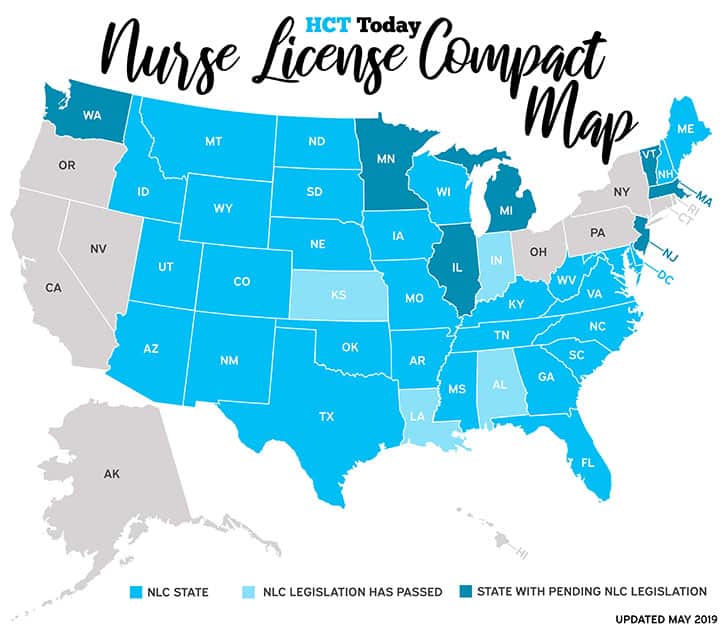

If you worked in a different state last year, you’ll also need to file state tax extensions.

It gets a bit tricky here because some states will automatically grant you an extension if you file for a federal extension, but not all of them do, and the failure to file penalty is sometimes even harsher at the state level.

You can find a full list of tax extension rules by state here.

Step #4: Do your homework

Now that your extension is squared away, it’s time to actually file your taxes. There are a wide variety of filing software programs you can use, but TurboTax is the most popular choice.

If the process seems too complicated or you’re not sure what information you need, consider getting help from a tax professional who understands how to properly file for travelers.

Consulting with a tax pro can help you avoid errors on your forms, and can also set you up for success by helping you establish a tax home or avoid filing mistakes on your forms because of the new tax reform changes.